Case Study

Velocity Risk drives dramatic efficiency and growth through winnability and appetite with Federato

Commercial E&S property hybrid MGA/Carrier reinvents underwriting workflow to capitalize on submission volume and solve for complexity.

Velocity Risk is a commercial excess and surplus property insurer, a hybrid MGA/Carrier founded by a team of industry veterans with a singular goal: swiftly leading on specialty property market challenges. By merging advanced technology capabilities, cutting-edge catastrophe modeling, and proprietary data insights—courtesy of a unique approach to capital markets, leveraging an ecosystem of market-leading global reinsurance and ILS capital providers—the company set out to reinvent expectations for excess property brokers and insurers. As a result, Velocity Risk delivers more competitive quotes significantly faster than the rest of the market.

"Velocity is and always has been in the relentless pursuit of a more efficient operation that can serve the challenged coastal wind-exposed property market. In Federato, we found a partner that shares our passion and intensity for solving the climate-challenged insurance problem. By constantly iterating and improving our workflow with the RiskOps platform, we’ve been able to 3.7x the percentage of our bound policies that meet our definition of high appetite, further extending our leadership in the markets we serve while building trust with our capital providers, customers, wholesale partners and employees.” - Rod Harden, President of Claims and Operations, Velocity Risk

Velocity’s speed-centric strategy drove success for years, establishing it as a go-to partner for brokers due to its efficient process. However, by 2023, Velocity's submission volume had become challenging to manage, receiving over 50,000 submissions per year. While much of this risk was in-appetite, Velocity previously used a “first in, first out” system to process submissions. This approach meant underwriters spent considerable time screening submissions that were not advantageous to the portfolio and had a low likelihood of acceptance. Without automated intelligence for scoring risks based on the propensity to bind, underwriters risked manually working on time-intensive quotes with lower binding potential.

Despite their technologically sophisticated and efficient back-office operations, Velocity's underwriting process remained reliant on manual processes. This slower-than-ideal process prompted the need for dramatic workflow improvements and enhanced efficiency in identifying the best risks to bind to the portfolio.

With explosive growth, Velocity found it increasingly difficult to maintain its trademark speed while ensuring no compromise to the quality of the business written. By early 2023, the average time from submission analysis to quote issuance had grown to over 20 days, despite an efficient single-deal process, due to the sheer volume of incoming submissions.

Velocity recognized the need for an underwriting platform that could keep pace with their rapid growth and help underwriters prioritize the right deals. They turned to Federato to address their risk prioritization challenge and organize submissions more effectively. Federato's RiskOps platform could codify Velocity’s proprietary “VISTA” algorithm-based rules and appetite, while also analyzing a deal’s winnability using secondary data from the underwriting process.

By efficiently surfacing the best deals in an underwriter’s submission stack, Velocity aimed to enhance focus and efficiency, outperform the competition, and secure the right deals faster. This approach would create a virtuous cycle: the underwriting team would gain confidence in their abilities, reinsurance partners would trust Velocity’s capacity to deliver, and wholesalers/brokers would be assured of quicker decisions on their submissions.

Velocity and Federato share common cultural traits, favoring speed, continuous improvement, and the reimagination of conventional workflows for better outcomes. These commonalities were evident in Velocity’s RiskOps implementation. After a brief user testing period over the summer, Velocity went live with Federato RiskOps in September 2023 and began writing business. Throughout the implementation, the teams identified several opportunities to improve Velocity’s underwriting workflow.

“Federato has solved what had been a persistent problem for us by providing a flexible and configurable platform that simplifies complexity and enables collaboration across our team, letting us focus on the technical pricing and speed that differentiates our business, while spending a minimal amount of time wrangling old technology.” - Chris Gunderson, CTO, Velocity Risk

Before RiskOps, Velocity struggled to consolidate meaningful metrics and data into a concise view for prioritization. With Federato's help, they now integrate these scores, along with a comprehensive ruleset codified into the system, into a primary appetite score.

The appetite score is then combined with the winnability score to categorize each deal into a quadrant of “Matrix Scores”:

Starting their day with deals in Quadrant 1 allows underwriters to focus on the most critical opportunities in their pipeline. After thoroughly reviewing these top-priority deals, underwriters can then address Quadrants 2 and 3, which may require more detailed analysis and research. This approach helps minimize distractions from less desirable risks in Quadrant 4, ensuring a more efficient and focused workflow. By matrix-scoring & prioritizing high-appetite, high-winnability deals, Velocity Risk wins the right deals faster.

“We set a goal that by noon each day, each underwriter should have quoted the best three or four deals on their desk. To do that, they have to focus on what’s in-appetite and winnable, rather than which brokers are most vocally calling for a quote. That puts the power in their hands to be more selective and write the best business quickly, and to spend more time on the deals and relationships where their particular skills can come into play.” - Nina Chiapetta, VP of Business Development, Velocity Risk

“As a relatively junior underwriter, I have greater peace of mind that I’m writing the right risks and making the right choices, because I have a system that helps me stay aligned with my organization’s preferences and goals.” - Ghiche Bradley, Middle Market Underwriter Assistant, Velocity Risk

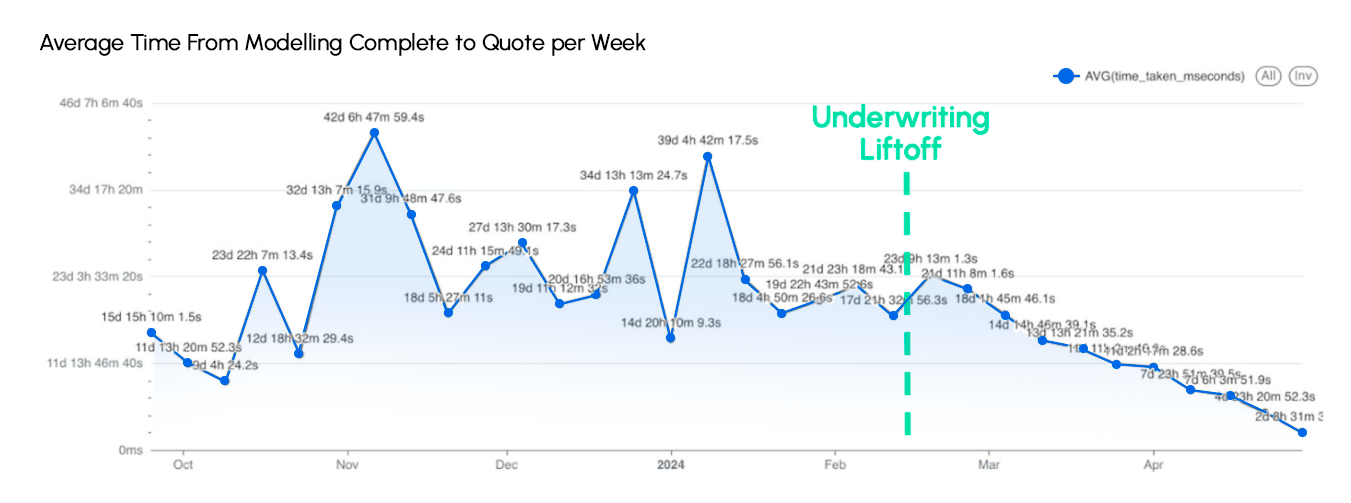

After implementing the quadrant system in RiskOps, Velocity quickly noticed an improvement in their underwriters’ efficiency and overall performance.

Within just two months, the average time from a submission being modeling-complete to issuance of a quote dropped from 21 days and 11 hours to 2 days and 8 hours—an 89% reduction. The percentage of quoted policies deemed high appetite and the percentage of bound policies categorized as high appetite increased threefold. These results highlight the significant impact of the winnability score on Velocity’s business, with bound business growing faster than quoted business.

Velocity plans to keep refining their underwriting workflow to achieve even greater improvements and optimize results. Ongoing adjustments to the rules guiding appetite scoring are enhancing efficiency and profitability, while winnability scoring becomes increasingly accurate with each quarter.

Federato is proud to provide a platform that can power a team as ambitious and effective as Velocity Risk. Ready to learn more? Book a demo to get started with RiskOps.